E-mobility steps on the gas

Mobility is about to undergo disruptive changes. These changes will reshape not only the means of transportation we use, but also the entire value chain of the automotive industry.

Electric cars are really ancient history. Just like the drawbacks associated with them. In 1888, the German mechanical engineer Andreas Flocken “raced” through the southeastern German city of Coburg in an electric carriage that could travel up to 15 km/h. Around 1900, about 40 percent of all cars in the United States were electric. But due to these vehicles’ low battery capacity and short range that resulted from it, gasoline-powered engines soon left them in the dust.

Today, more than a century later, the “chargers” are making a comeback. A new study issued by the German Mechanical Engineering Industry Association and FEV Consulting forecasts that nearly 45 percent of all 128 million cars sold in 2040 will be all electric or powered by fuel cells. The number of vehicles powered by internal combustion engines around the world is expected to decline by 16 percent compared with levels in 2019.

In particular, Europe will experience a powerful shift. Tougher emissions standards imposed as part of the EU’s “Green Deal” will likely result in a ban on the sale of new vehicles powered by internal combustion engines in Europe in 2040. The role of fuel-cell vehicles will also grow along with that of electric cars—the study envisions a market share of about 22 percent for them.

This transformation will have a massive impact on value creation and investment in the core markets of automotive mobility: Europe, the United States and China.

Sales of electric drive-train components are expected to surge by about 75 percent to €403 billion by 2040. By contrast, sales of classic internal-combustion-engine technology are forecast to plummet by up to 80 percent.

Future growth drivers will be electric systems and components like batteries, electric motors, power electronics and fuel-cell components. At the same time, value creation will shift from manufacturing-intensive processes to increased use of materials.

Electromobility in times of coronavirus

But the progress being made in e-mobility is sluggish at best—at least in Germany. The German government has set the goal of having at least 10 million electric cars on the country’s roads by 2030. It is a goal that the business consulting firm Deloitte described as challenging even before COVID-19 struck. And it reached this conclusion even though the expansion of electromobility remains a key element of German climate policies and is continuously being made a higher priority by business and political leaders. But Deloitte argues that the automotive industry has been unable to more forcefully end its dependency on the profitable business with internal combustion engines and shift to electromobility, a technology that remains unprofitable.

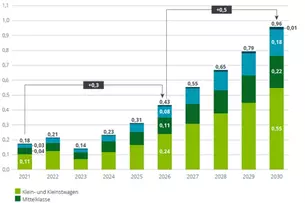

The consulting firm’s analysts estimate that the impact of COVID-19 will cause cumulative sales of vehicles powered by alternative drives to plunge by 500,000 units through 2030. But the economic recovery package recently approved by the government could offset this negative effect and fuel the purchase of 650,000 additional units. However, in January 2020—before the crisis began—Deloitte forecast that the number of newly registered vehicles equipped with alternative drive systems would reach 6.2 million by 2030. This would mean that the goal of 7 million to 10 million e-vehicles/plug-in hybrids proposed by the government and required by CO2 regulations would be missed by nearly 4 million vehicles.

At the moment, electric cars are selling well in Germany: In March 2021, about 30,000 all-electric cars and more than 81,000 hybrid vehicles were newly registered, according to the German Motor Transport Authority—nearly triple the number from 2020. But it remains to be seen whether this increase is not just a one-hit wonder, the product of a burst of government subsidies. Deloitte’s new “Global Automotive Consumer Study” notes that the number of respondents who want their next car to be equipped with an alternative drive system has fallen to levels last seen in 2018. Currently, just 41 percent of respondents want to buy this type of vehicle when they purchase their next car. The total was 51 percent in 2020 and 37 percent the year before. But the analysts also do not see a general return to classic internal-combustion-engine vehicles. The long-term trend among consumers is heading clearly in the direction of sustainability, they note.